- Platform

- Solutions

- Expose and Manage ThreatsContinuously identify, expose and remediate critical threats

- Reduce Attack SurfaceThe roadmap to reducing your attack surface

- Control Subsidiary RiskManage cyber risk across all your subsidiaries

- Cloud Attack SurfaceReduce Cloud Security Noise by Focusing on What Really Matters

- Improve Security PostureReduce risk systematically

- Manage M&A riskEvaluate candidate’s cyber risk

- Threat Center

- Learn

- Company

Threat Exposure Radar ExplainedSolutions

IONIX Cloud Exposure ValidatorProductM&A CYBER RISK

Evaluate M&A Candidates’ Risk Exposure

Cybersecurity threats are on the rise. This makes it more important than ever to evaluate cyber risk from the very first step in mergers and acquisitions (M&A). To help enterprises gain risk visibility, IONIX conducts a non-intrusive attack surface discovery and assessment. With the IONIX Attack Surface Executive Report, decision makers gain visibility and insights into the security posture and risk exposure of the acquisition candidate. Armed with this data, you can decide on the merits of an offer and its cybersecurity risks.

DUE DILIGENCE RISK CONTROL

Discover and Control Attack Surface Risks

M&A deals can be derailed by critical cybersecurity incidents. Cybercriminals and ransomware actors actively target companies involved in M&A using fear of exposure to extract payments, according to a recent FBI warning.

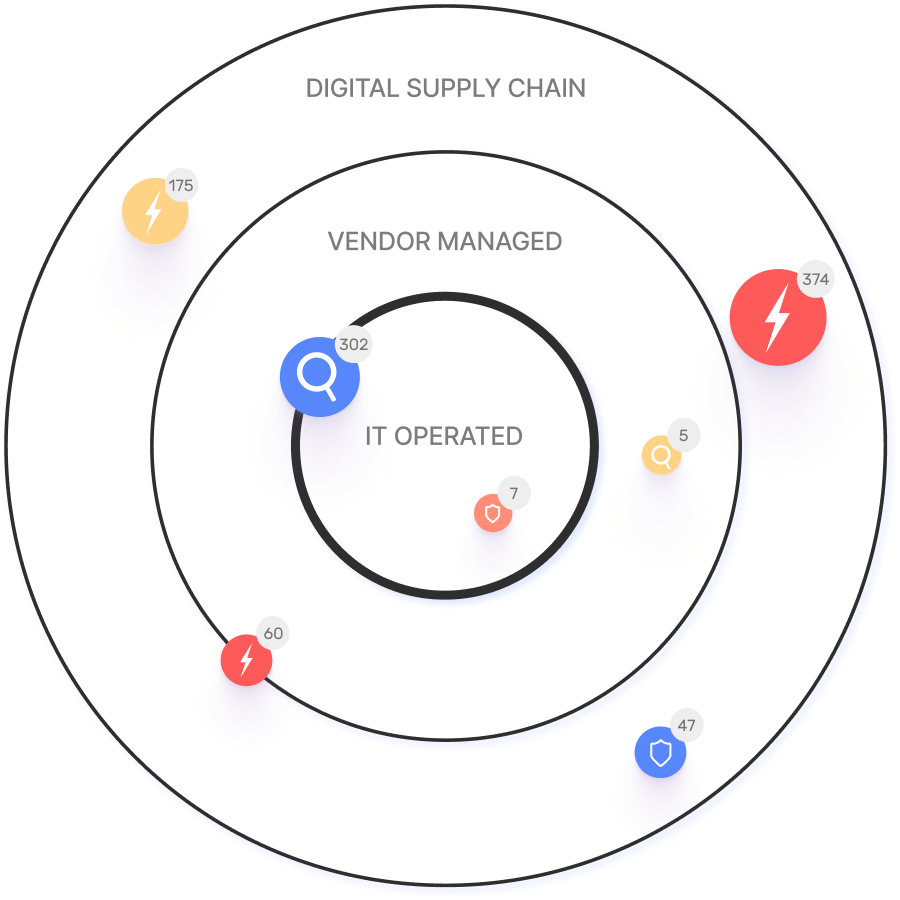

Don’t let cybercriminals be your discovery engine. Find your risks first with IONIX Attack Surface Management. Automatically map your M&A candidate’s real attack surface and digital supply chain – across hybrid IT environments on-premises, cloud, and SaaS. The platform exposes security gaps, risks, and potential liabilities, prioritizing them based on exploitability and blast radius, providing clear risk visibility and remediation action items.

SECURE M&A INTEGRATIONS

Complete Acquisitions with Secure Integrations

As an acquired company’s assets merge into core business operations, high-value data often becomes exposed. Threat actors are quick to identify such exploit opportunities whenever companies announce an M&A.

The IONIX platform enables you to keep an eye on your changing the attack surface, expose risks, and fix urgent and critical security issues quickly. During integrations, IONIX provides and up-to-date mapping to make sure no dangling connections or exposed systems are left behind.

WATCH A SHORT IONIX DEMO

See how easy it is to implement a CTEM program with IONIX. Find and fix exploits fast.

- Solutions