FTX, risk management, and attack surfaces – Visibility is the Key

The FTX crypto disaster is a great lesson in risk management. It brings into focus the importance of knowing where your valuables are and how they are being managed.

The Rise and Fall of FTX

FTX was founded in 2019 and rapidly became one of the largest crypto exchanges. It was led by a 30-year-old entrepreneur, Sam Bankman-Fried. Like Elizabeth Holmes from the Theranos saga, Sam had friends in all the right places. He attracted big names and world-class investors who gave the firm, and him, instant credibility.

FTX was intended to be a platform for investors to trade in crypto. Think of it as an eTrade or Fidelity brokerage account. When using an exchange, you fund your account and invest your money. It is a red line, a very criminal red line, for an exchange to use client funds for their own investing purposes.

FTX had a venture investing operation called Alameda. It was led by a 28-year-old woman named Caroline Ellison, who wrote that people who “really don’t want to lose all of their money” are “lame.” Her ideas on risk management include, “This blog endorses double, or nothing coin flips and high leverage.” While that is certainly troubling, at least Alameda is investing the firm’s funds and not investors.

That’s what investors thought until last week.

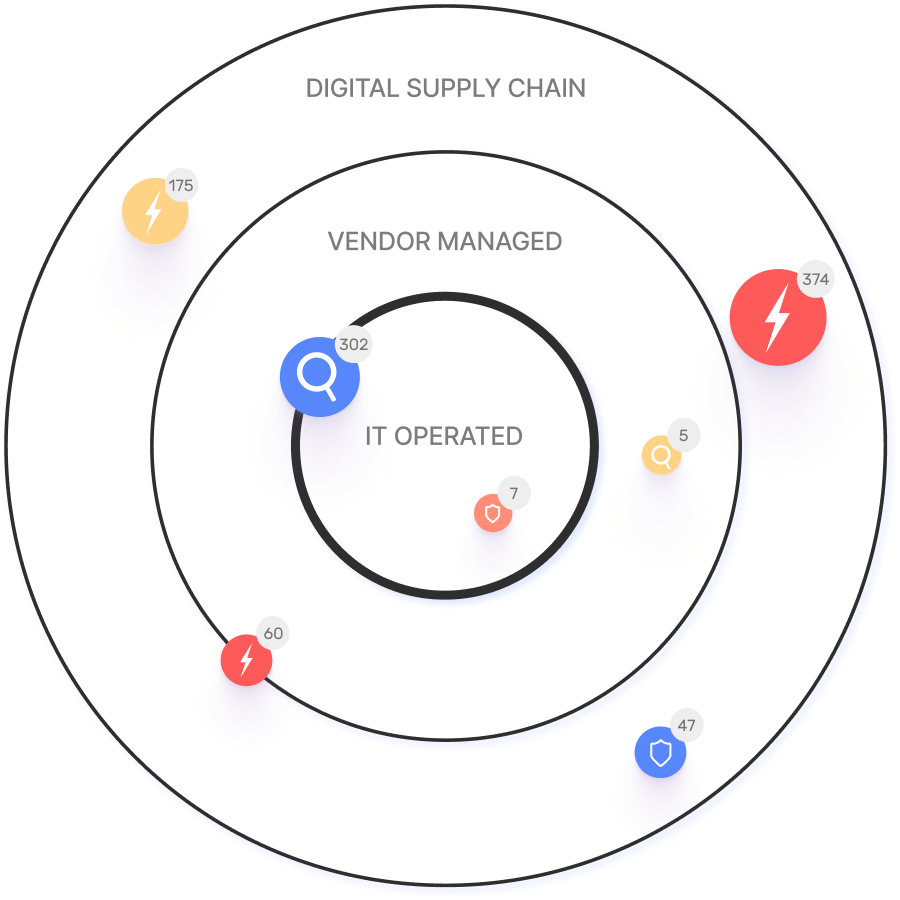

According to various news reports, it appears that FTX gave its venture arm Alameda up to $8B in client funds to speculate in more than 400 various crypto investments recklessly. See the chart below.

The definition of risk exposure

Suddenly, clients had their own money riding on hundreds of investments they never heard of.

The risk exposure of FTX clients wasn’t just in whatever crypto investments they made on the platform. It spread across all the investments made by Alameda and their careless CEO.

The threat surface for their portfolios was suddenly a tangled web of investments in products they didn’t know existed and certainly had never heard of.

That is the definition of risk. Being entwined and connected to things outside of your knowledge and control. That’s a helpless place to be.

Attack Surface Risk Exposure

It’s hard for us not to draw parallels to any enterprise organization today. They have their own portfolio of IT assets that they are responsible for securing. With the growing prevalence of SaaS, cloud, and 3rd party vendors, organizations are relinquishing direct control of everything valuable, from data to IT infrastructure. As their internet exposure continuously expands, unseen and unmanaged by security and IT teams, any cloud misconfiguration or unsecured connection can become an easy entry point for attackers to exploit.

What are the implications of these blind spots for security teams? It’s like operating in the dark but with a constant ominous premonition. You can’t see the threat, but you know it’s there.

Visibility in Hindsight

In many cases, cybersecurity teams continue to operate blindly until bad news breaks. A cyber attack is the starting gun for investigations to stitch all the pieces together and identify the vulnerability and attack vector. Where did that threat originate? How did it progress? What weaknesses did it exploit?

The Urgent Need for Attack Surface Visibility

Whether it is your investments or your enterprise assets, having an understanding of your risk exposure is essential. For today’s hyper-connected enterprise, this is far from simple. That should be a warning sign in and of itself.

To achieve this, enterprises need an advanced attack surface management platform that discovers an enterprise’s online exposure. With attack surface visibility, security teams can shift gears and proactively eliminate risks before they’re exploited.

Book your demo to learn how the IONIX ASM platform provides total attack surface visibility for hyper-connected enterprises.